GENERAL INSURANCE SERVICES

Before applying for medical insurance, please download the forms below:

Medical report (mandatory self declared report for all)

Additional medical report (46 years and above only must get it signed by the examining physician)

Medical Insurance

ApplyFrequently Asked Questions

Who can apply?

Any Bhutanese aged 18 – 70 years and foreigners who have resided in Bhutan for more than 6 months aged 18 – 70 years.

What is Sum Insured?

The maximum amount of money the applicant chooses for RICB to pay for the applicant’s medical expenses.

What is premium?

The amount of money that the applicant pays for Medical Insurance monthly/quarterly/half-yearly/annually.

What amounts of sum insured are offered in Medical Insurance?

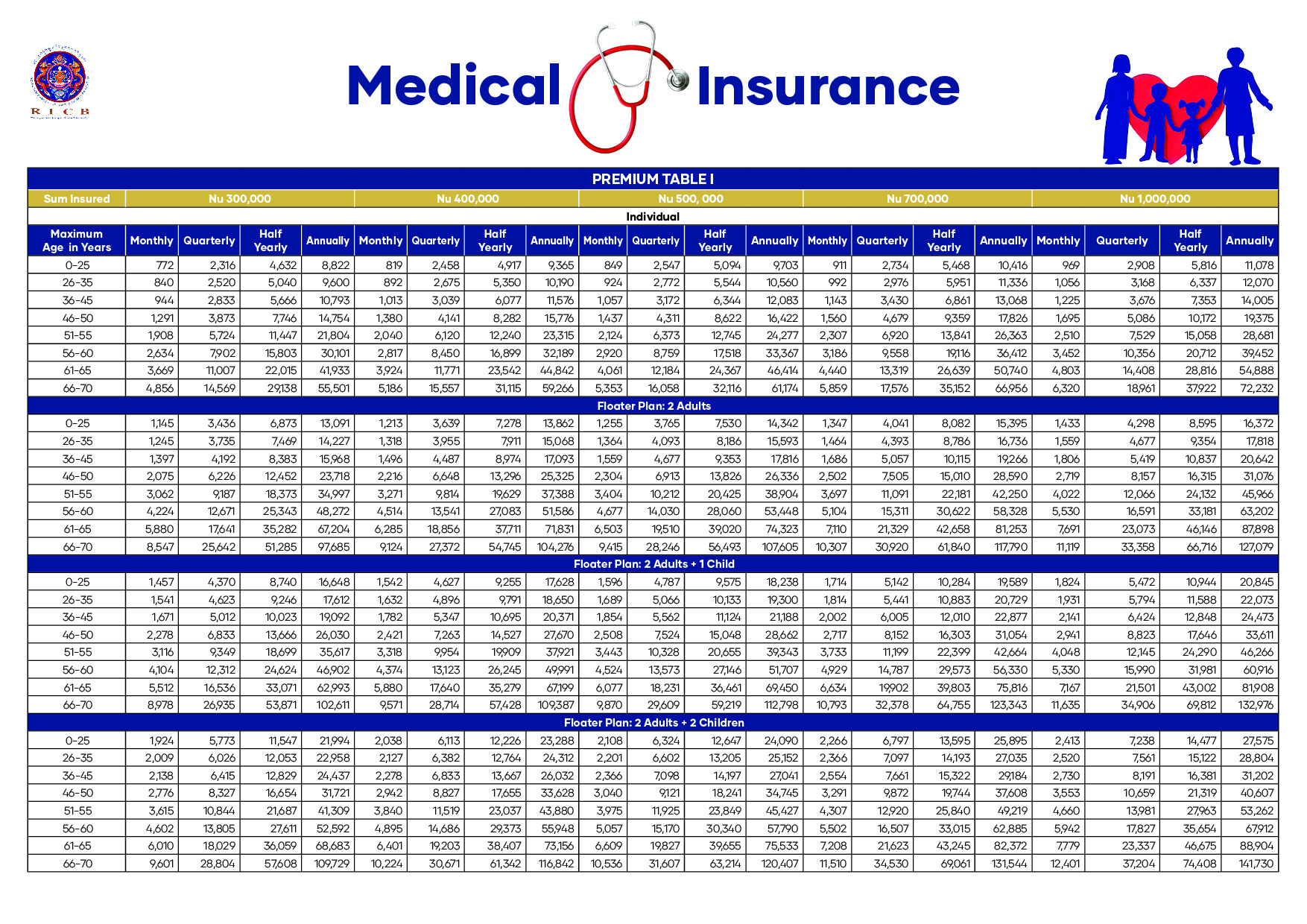

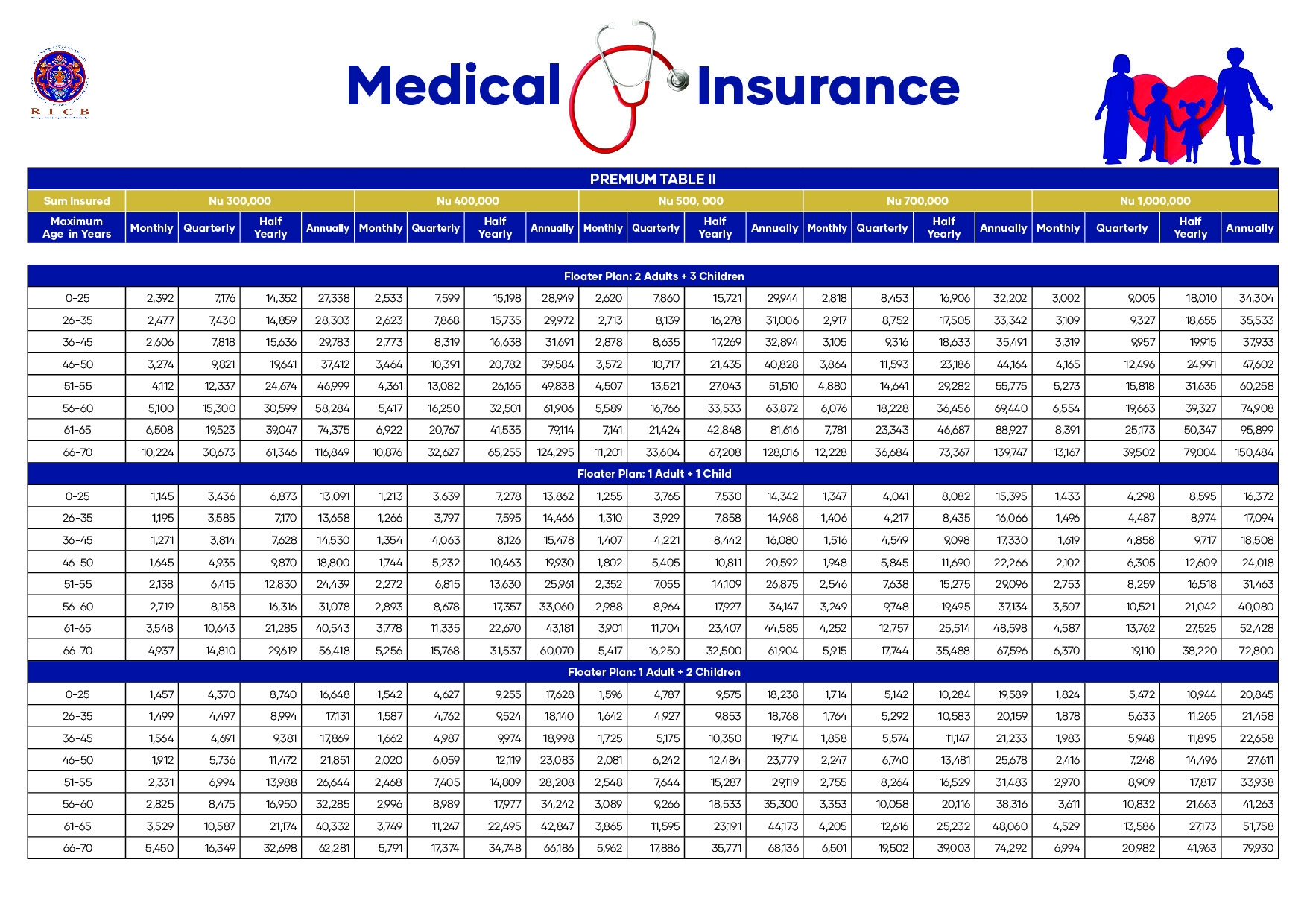

The sum insured varies from Nu 300,000/Nu 400,000/Nu 500,000/Nu 700,000/Nu 1,000,000.

How is your premium calculated?

Since the Medical Insurance covers up to 5 family members, the premium will be calculated based on the eldest family member’s age. For instance, if the husband is 40-years-old and the wife is 34, and the child is 7-years-old, the premium will be calculated on the husband’s age since he is the oldest member in the family.

How can you know your premium?

Please check our premium table in the image. Choose the sum insured (Nu 300,000/Nu 400,000 or Nu 700,000 or more) with the Floater Plan of preference. Then choose your age bracket with frequency of premium payment (Monthly/Quarterly/Hal-year/Annually).

Who are included in the immediate family members?

Spouse and children only.

Who is the insured?

Includes applicant, the applicant’s spouse, and the children or just an applicant if unmarried, or couple if no children.

Who is the nominee?

Spouse or children who the applicant wants to handle the Medical Insurance if something happens to the applicant.

How many people can be covered under one policy?

Up to 5 family members, including husband, wife and 3 children are covered under one policy.

What is covered in Medical Insurance?

- In-patient treatment.

- Day-care treatment.

- Pre- and Post-hospitalisation expenses.

- In-patient AYUSH Hospitalisation (Ayurveda, Yoga, Naturalpathy, Unani, Sidda, and Homeopathy).

- Domiciliary hospitalization.

- Domestic road ambulance.

- Free medical check every two years if no referrals were availed after policy inception.

- Pre-existing diseases covered two years after the inception of the policy.

- No room rent limit

- Cashless hospitalization.

What is not covered under the Medical Insurance?

- Pre-existing diseases for 2 years (Expenses related treatment of pre-existing diseases and its direct complications).

- Expenses related to treatment listed conditions or surgeries or treatments for 2 years after the policy inception. The listed conditions include, cataract, benign prostatic hypertrophy, all types of hernia, arthritis, gout, sinusitis, stones in urinary and binary systems, skin and internal tumors, dialysis for chronic renal failure, surgery on tonsils, investigation and evaluation, rest cure, rehabilitation, and respite care, and weight control, change of gender treatments, plastic surgery, hazardous and adventurous sports, breach of law, excluded providers, treatment for alcoholism, drug or substance abuses, dietary supplement that can be bought without prescriptions, correction of eyesight refractive error less than 7.5 dioptres, unproven treatments, sterility and infertility, and maternity, among others.

But is accident covered in Medical Insurance for applicants with pre-existing diseases?

Yes, the accidents are covered for both applicants with and without pre-existing diseases provided the policy is active.

Do you need referral letters from the referral committee to avail the Medical Insurance?

No. A recommendation letter from any practicing physician, including from physicians from private clinics will work.

Do you need any medical reports from diagnostic centres to apply for Medical Insurance?

No but for applicants above 46 years of age will required produce eight medical test reports.

What are the eight medical tests required for applicants who are 46-years-old and above?

- Blood profile

- Lipid profiles

- Urine analysis

- Blood pressure test

- Blood sugar level

- Liver function test

- Kidney function test

- Tests for vitamin deficiencies

Does the Medical Insurance coverage begins immediately after insuring?

No. The Medical Insurance coverage begins only after a waiting period of 30 days from the date of policy inception for applicants without pre-existing diseases. The waiting period for applicants with pre-existing diseases, however, is two years after the inception of the policy.

Which countries are covered by Medical Insurance?

For now, India only.

Which states under India are covered by the Medical Insurance?

All 28 States, including Assam and Siliguri.

Can you view the list of our partner hospitals anywhere?

Yes. You can visit the networks on our Medical Insurance partner’s website, the ICICI Lombard website.

How can applicants process the Medical Insurance?

Visit us with duly completed Claim Form (Available on ricb.bt) signed by the applicant and the physician and with other related documents, including medical bills and case papers.

Is it possible for RICB to make a mass presentation for organisations/agencies?

Yes. Our team is willing to provide any presentation for organisations/agencies. Contact us @ 17342100/ 17835232 during office hours only.

Definitions

- Accident is an unplanned and unforeseen event that results in damage, injury, or harm to people, property, or the environment.

- Day care procedure & treatment refer to medical or surgical procedures that do not require an overnight hospital stay.

- Domiciliary Hospitalization refers to a healthcare service where patients receive treatment and medical care at their own homes instead of in a hospital or healthcare facility.

- In-patient Treatment refers to medical care or therapy that requires the patient to stay overnight or for an extended period in a hospital or healthcare facility.

- Pre-existing Diseases refer to any health condition or illness that an individual has before obtaining medical insurance coverage or seeking medical treatment.

- Pre-hospitalisation refers to medical care or services provided to a patient before they are admitted to a hospital.

- Post-hospitalization refers to the period of medical care and support provided to a patient after they have been discharged from the hospital.

- Third Party Administrator (TPA) is a licensed intermediary between medical insurance policyholders and insurance companies. A company or entity that processes cashless insurance claims, provides network facilities, and offers various administrative services on behalf of insurance companies.

- Waiting Period refers to the duration of time during which the policyholder is not entitled to receive benefits or coverage after purchasing the insurance policy.